How a Unified GGR Tax System Boosts Investment and Strengthens Ukraine’s Public Finances

Wednesday 12 de November 2025 / 12:00

2 minutos de lectura

(Kyiv).- Transparent and consistent tax rules are essential for attracting investment, protecting players, and ensuring the sustainable growth of Ukraine’s legal gambling market.

The primary goal of any business is to generate profit. To understand profitability, a company must clearly define its cost structure — and taxation plays a key role. When tax systems are transparent and rates are predictable, businesses can plan, develop, and invest with confidence. Unfortunately, Ukraine currently lacks clear taxation terms for the gambling industry. Even basic concepts remain undefined, hindering the development of the legal market and strengthening illegal operators.

Tax legislation forms the backbone of any regulatory framework, particularly in commercial sectors. It directly influences how attractive a market is to investors. Gambling operators are generally willing to comply with complex licensing requirements if they can operate profitably under fair and transparent tax rules.

However, Ukraine still has no unified system for taxing gambling businesses. Fundamental terms such as “winnings” and “gross gaming revenue (GGR)” have not been clearly defined. Without these, consistent taxation rules cannot be established. As a result, foreign companies hesitate to invest or do so cautiously, as unpredictable taxes erode potential profits.

This creates two major challenges:

Excessive taxation on winnings discourages players. Many prefer illegal platforms to avoid high tax deductions, which weakens the legal sector and fuels the growth of the shadow market.

Unclear tax definitions complicate state oversight. The government cannot effectively control or collect taxes without a legally established method for calculating GGR.

While discussions about adjusting tax rates — whether fixed or progressive — may take time, Ukraine must first align its tax terminology with international and EU standards. This step would benefit the state, players, and licensed businesses alike.

Establishing a unified tax base and clear definitions for winnings and GGR is not just a technical fix; it is a strategic move to attract legal investment, stabilize state revenue, and protect players. Countries like Lithuania (13% GGR tax) and Estonia (4–6% GGR tax) demonstrate that clarity and predictability encourage both compliance and investment.

A consistent tax framework will prevent manipulation, eliminate subjective interpretations by tax authorities, and reduce the migration of players to illegal operators. Ultimately, this will enhance player protection, increase state budget revenues, and help Ukraine build a stable, transparent, and investor-friendly gambling market.

Categoría:Legislation

Tags: Sin tags

País: Ukraine

Región: EMEA

Event

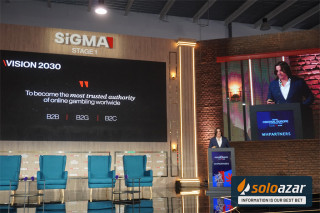

SiGMA Central Europe

03 de November 2025

Amusnet Showcases Multichannel Strength at SiGMA Central Europe 2025

(Rome, SoloAzar Exclusive).- At SiGMA Central Europe 2025, Amusnet reaffirmed its position as a leading multichannel supplier. Polina Nedyalkova, Director of Amusnet Italy, highlighted the company’s comprehensive portfolio spanning Online casino, Live casino, and Land-based solutions, while underlining Italy’s strategic importance for the group.

Tuesday 18 Nov 2025 / 12:00

Dual Brand Strategy: Amatic Classics and Wildcat Innovation Impress at SiGMA Central Europe

(Rome, SoloAzar Exclusive).- Riccardo Cavallaro, Amatic Online Project Manager, granted an interview to SoloAzar about the recent participation at SIGMA Central Europe. Amatic Online and Wildcat Gaming took center stage, showcasing a powerful mix of trusted classics and bold new releases. He described how both brands resonate strongly with operators and together deliver a complementary, future‑ready portfolio.

Monday 17 Nov 2025 / 12:00

SiGMA Central Europe Awards EGT Digital the Title of Fastest Growing Aggregator 2025

(Sofia).- EGT Digital has been awarded the “Fastest Growing Aggregator 2025” title at this year’s SiGMA Central Europe exhibition in Rome.

Monday 17 Nov 2025 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.