U.S. Online Sports Betting 2024: map of Taxes by State

Thursday 19 de September 2024 / 12:00

2 minutos de lectura

(Columbia).-Legal sports betting has grown rapidly since the Supreme Court granted states the ability to establish online sports betting markets in Murphy vs. NCAA in 2018

Legal sports betting has grown rapidly since the Supreme Court granted states the ability to establish online sports betting markets in Murphy vs. NCAA in 2018. Pre-Murphy, consumers could only bet legally in a handful of states, but today, 38 states and Columbia allow sports betting in some form.

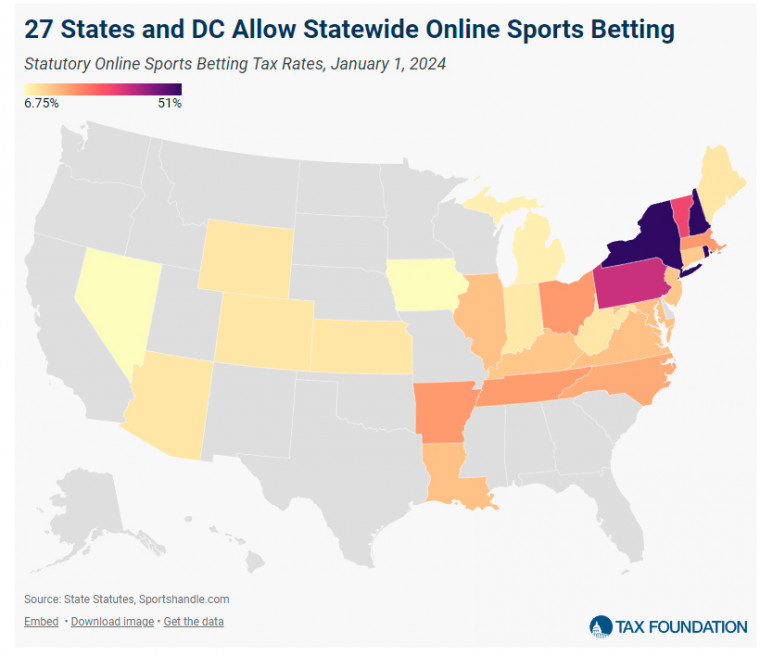

However, sports betting markets vary substantially across states that have legal betting markets. Notably, states apply a range of different tax rates (sometimes differentiating between online wagers and brick-and-mortar wagers), and access to legal sports betting can be quite limited.

Consumer access to legal betting markets is limited primarily by high barriers to entry for sports betting operators who wish to offer services in the state and by limits on the geographic locations at which players are allowed to place bets.

Common barriers facing operators include expensive licensing fees and requirements for online sportsbooks to partner with existing in-state brick-and-mortar operators. In Massachusetts, for example, sportsbooks must pay an initial fee of $5 million, with another $5 million renewal fee every five years. Sportsbooks in Pennsylvania are required to pay a one-time fee of $10 million and a $250,000 renewal fee every five years.

New jersey requires online sportsbook operators to partner with a licensed brick-and-mortar racetrack or casino in the state, while Ohio offers online sportsbooks the option to partner with a professional sports organization approved by the Casino Control Commission to offer mobile sports wagering.

Other states mandate a partnership with the state lottery commission or hand control of online sports betting markets to the state lottery commission. In Connecticut, online gaming operators wishing to offer services in the state must partner with a state-approved master gaming operator. Montana monopolized all sports betting under the Montana Lottery Commission.

Several states also restrict where players can gamble online. In Delaware, Mississippi, Montana, New Mexico, North Dakota, South Dakota, Washington, and Wisconsin, would-be gamblers can only place bets at select locations such as retail casinos, state-operated facilities, or tribal lands.

In other states, online wagers are treated differently from wagers placed in person. In Kentucky, Louisiana, Massachusetts, New Jersey, and New York, online wagers are taxed more heavily than retail (in-person) wagers.

While 38 states have legalized sports wagering in some capacity, bettors only have statewide access to online sports betting platforms in 27 states and the District of Columbia. New Hampshire, New York, and Rhode Island apply the highest tax rate to sportsbooks at 51 percent. Nevada and Iowa apply the lowest tax rates at 6.75 percent. Today’s map shows the distribution of online sports betting tax rates across US states.

The market for sports betting will likely continue to grow substantially. Texas and California don’t yet permit legal sports wagering markets. With nationwide legalization, sports betting market volume could easily double.

As the tax base grows, tax policy design becomes increasingly important. Rates should be low enough to pull participants out of black markets and into the legal, regulated markets.

Categoría:Legislation

Tags: Sin tags

País: United States

Región: North America

Event

ICE Barcelona 2026

19 de January 2026

NOVOMATIC 2026: Global Expansion and Comprehensive Strategy in the Gaming Industry

(Barcelona, SoloAzar Exclusive).- NOVOMATIC AG kicked off 2026 with strong momentum, underscored by its standout presence at ICE Barcelona. Thomas Schmalzer, VP of Global Sales and Product Management, highlighted the company’s presentation of its integrated 360-degree portfolio—spanning cabinets, gaming content, and system solutions—while reinforcing global partnerships and advancing into new markets.

Friday 06 Mar 2026 / 12:00

Nadia Popova from EGT on ICE Barcelona 2026:"The new concept of our stand made a strong impression on visitors"

(Barcelona, SoloAzar Exclusive).- In this post-event interview from Barcelona, Nadia Popova, EGT’s Chief Revenue Officer and VP Sales & Marketing shares insights on the company’s standout presence, its “All eyes on us” stand concept, key product highlights, and the strategic partnerships forged at ICE Barcelona 2026.

Friday 20 Feb 2026 / 12:00

Luz Beatriz Jaramillo Serna of 21Viral: “Our presence at ICE Barcelona 2026 was exceptionally positive”

(Barcelona, SoloAzar Exclusive).- Following her participation at ICE Barcelona 2026, Luz Beatriz Jaramillo Serna, Head of Business Development, Marketing and Sales for Latin America at 21Viral, analyzes the commercial impact of the event, the trends set to shape the industry’s direction, and the company’s strategic priorities to consolidate growth across the region and new regulated markets.

Monday 16 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.