Take a look at the AGA Commercial Gaming Revenue Tracker

Wednesday 19 de June 2024 / 12:00

2 minutos de lectura

(United States).-The American Gaming Association's (AGA) Commercial Gaming Revenue Tracker provides financial performance data for each state and the nation as a whole, including detailed breakdowns for individual gaming sectors

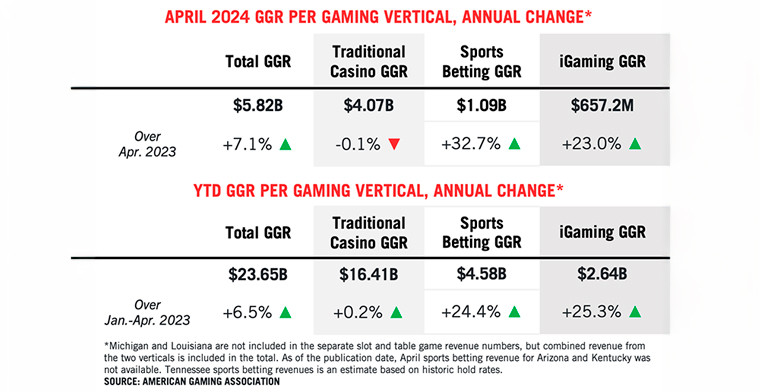

U.S commercial gaming revenue grew 7.1 percent in April compared to the previous year, the industry’s 38th consecutive month of annual growth. According to state regulator data compiled by the AGA, the gaming industry’s earnings from traditional casino games, sports betting, and iGaming reached $5.82 billion, a new April record.

From January to April 2024, commercial gaming revenue totaled $23.65 billion, 6.5 percent higher than last year’s record pace.

Of the 34 commercial gaming jurisdictions that were operational a year ago and had published complete April data, 21 reported an increase in combined revenue from traditional casino games, sports betting and iGaming compared to the previous year. Sports betting revenue was not yet available for Arizona and Kentucky at the time of writing.

Land-based gaming experienced a slight decline in April. Combined monthly revenue from traditional casino games and retail sports betting reached $4.09 billion, a 0.5 percent year-over-year drop. Retail sports betting revenue saw a significant 40.9 percent decline, while revenue from traditional casino games fell by 0.1 percent.

Online gaming continued to show strong growth. Revenue growth surged from 11.0 percent in March to 30.9 percent in April, driven by increased growth in online sports betting revenue (+36.2%) and iGaming revenue (+23.0%).

In April, traditional casino slot machines and table games generated revenue of $4.07 billion, a 0.1 percent decrease from the previous year. Slot machines contributed $3.00 billion, a 0.4 percent increase from April 2023, while table games brought in $777.3 million, up 0.3 percent. Broken-out slot and table game figures exclude data from Louisiana and Michigan, which only report combined slot and table game revenue. Both Louisiana and Michigan experienced revenue declines in combined slot and table game revenue in April, leading to the drop in total nationwide traditional gaming revenue despite the increases in broken-out slot and table game revenue.

Note that the year-over-year comparison was affected by an unfavorable calendar, as April 2024 had eight weekend days compared to nine in April 2023.

At the state level, 17 out of the 27 states with traditional casino slot machines or table games reported revenue declines compared to April 2023, with a median revenue drop of 1.8 percent across all states.

For the first four months of the year, combined revenue from casino slot machines and table games totaled $16.41 billion, a 0.2 percent increase over the same period last year.

Land-based and online sportsbooks collectively generated $1.09 billion in revenue across 32 commercial jurisdictions in April, not counting Arizona or Kentucky as neither had reported April figures at the time of publication. April sports betting revenue was up 32.5 percent from April 2023 when commercial sports betting markets were active in 29 jurisdictions.

Excluding the impact of new sports betting markets launched since last April (Kentucky, Maine, North Carolina, Nebraska and Vermont) sports betting revenue grew organically by 12.2 percent year-over-year. North Carolina became the third-highest-grossing state in its first full month of sports betting operations, generating $105.3 million in revenue.

Year-to-date through April, commercial sports betting revenue totaled $4.58 billion, surpassing the same period last year by 24.4 percent.

The iGaming sector continued to experience strong growth in April, generating $657.2 million across seven active states, excluding the online poker-only market of Nevada. Although this was a decrease from $719.6 million in March, it still represented a 23.0 percent year-over-year increase and was the second-highest-grossing month ever for iGaming nationwide.

Year-over-year revenue increased in all six states where iGaming was active in April 2023.

Through April, iGaming revenue reached $2.64 billion, a 25.3 percent increase compared to the same period last year.

Categoría:Others

Tags: Sin tags

País: United States

Región: North America

Event

ICE Barcelona 2026

19 de January 2026

Nadia Popova from EGT on ICE Barcelona 2026:"The new concept of our stand made a strong impression on visitors"

(Barcelona, SoloAzar Exclusive).- In this post-event interview from Barcelona, Nadia Popova, EGT’s Chief Revenue Officer and VP Sales & Marketing shares insights on the company’s standout presence, its “All eyes on us” stand concept, key product highlights, and the strategic partnerships forged at ICE Barcelona 2026.

Friday 20 Feb 2026 / 12:00

Luz Beatriz Jaramillo Serna of 21Viral: “Our presence at ICE Barcelona 2026 was exceptionally positive”

(Barcelona, SoloAzar Exclusive).- Following her participation at ICE Barcelona 2026, Luz Beatriz Jaramillo Serna, Head of Business Development, Marketing and Sales for Latin America at 21Viral, analyzes the commercial impact of the event, the trends set to shape the industry’s direction, and the company’s strategic priorities to consolidate growth across the region and new regulated markets.

Monday 16 Feb 2026 / 12:00

Toni Karapetrov from Habanero on ICE Barcelona 2026: Regulated Growth, Localization and Strategic Expansion Drive 2026 iGaming Strategy

(Barcelona, Exclusive SoloAzar).- In this interview, Toni Karapetrov, Head of Corporate Communications at Habanero, shares insights from ICE Barcelona 2026, highlighting premium content innovation, high-level industry engagement, key iGaming trends such as localization and gamification, and the company’s strategic focus on regulated market expansion and sustainable growth in 2026.

Friday 13 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.