State of the online gambling market 2023 in Spain

2 minutos de lectura

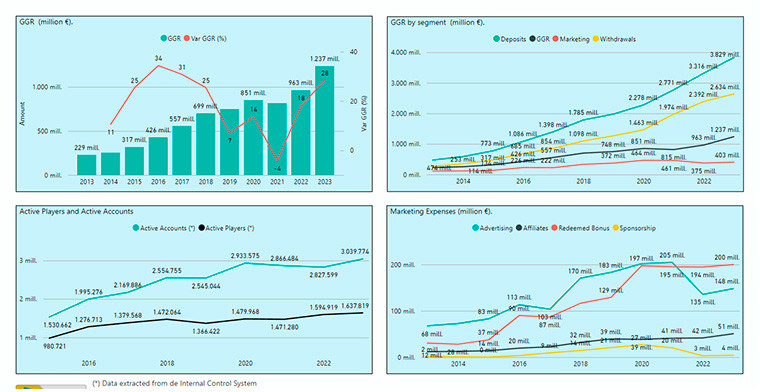

(Madrid).- The GGR for the quarter was € 315.29 million, an increase of 3.63% quarter over quarter and 0.55% year over year, according to a report by Directorate General for the Regulation of Gambling (Dirección General de Ordenación del Juego in Spanish).

Regarding the rest of the main figures, deposits and withdrawals of the players, their variation rates rise in relation to the previous year, 9.36% and 5.25% respectively. With regard to previous quarter, deposits grows 12.45% and withdrawals 19.34%. Marketing expenditure increases 20.91% quarter over quarter and new accounts experiences a growth with respect to the previous quarter, 20.11%. Details are shown in Table 1.

In the analysis of the GGR by game segments, it is observed that:

The € 315.29 million of GGR are distributed among € 114.73 million in Betting (36.39%); € 3.84 million in Bingo (1.22%); € 171.27 million in Casino (54.32%); € 0.05 million in Contests (0.02%) and € 25.41 million in Poker (8.06%).

The betting segment has a positive variation rate of 1.09% quarter over quarter and a decrease -18.83% year over year. There is a fall with respect to the previous quarter in pre-match, -75.98% and an increase in-played sportsbook, 58.13%. Other bettings have increased 30.66% this quarter, and horse betting 6.05%.

Bingo has experienced a growth of 5.35% quarter over quarter and 5.96% year over year.

In the casino segment, there has been a rise of 6.87% quarter over quarter and an annual variation rate of 20.23%. Slots has increased 25.86% and life roulette 15.26% year over year. Quarter over quarter, BlackJack slots and life roulette have growth 10.83%, 5,36% and 10.70%, respectively. On the other hand conventional roulette slightly decreases -0.80%.

Contests experienced a rise of 5.11% quarter over quarter and 61.48% year over year. This segment continues an irregular behaviour with annual variation rates in the fourth quarter of 75.86% in 2020; -95.65% in 2021; -36.73% in 2022.

Poker presents a decrease of -5.25% quarter over quarter and -2.49% year over year. Poker tournament had a negative variation rate of -8.69% quarter over quarter and -0.50% year over year. Poker cash increases 4.26% compared to the previous quarter and decreases -6.99% compared to the same quarter of the previous year.

As a summary, the percentage distribution of the GGR for the different segments in this quarter of the period from 2020 to 2023 is shown in Table 2.

Marketing expenses has been € 112.97 million in the last quarter. It may be broken down into € 13.95 million affiliation expenses; € 0.75 million sponsorship; promotions € 53.01; and advertising € 45.22 million. Compared to the previous quarter, marketing expenses increases 20.91% and 5.25% in annual variation. Quarter over quarter, Sponsorship decreases -14.40%; Affiliates increases 20.57%; Advertising 35.73% and Promotions, 11.28%. Year over year, Sponsorship decreases -57.59%; Affiliates -5.72%; Advertising increases 16.25% and Promotions, 2.27%. Promotions are broken down into cost of bonus included in prizes, € 13.87 million and cost of bonus not included in prizes, € 39.19 million.

The monthly average of active game accounts is 1,269,585; which implies an increase of 17.26% quarter over quarter and an increase of 6.76% year over year. The monthly average of the new game accounts is 129,207; with a growth of 20.11% quarter over quarter and a decline of -2.31% year over year.

For this quarter, there are 78 licensed operators and the number of active operators by segment is:

- Betting: 43

- Bingo: 3

- Casino: 49

- Contests: 2

- Poker: 9

Categoría:Reports

Tags: Sin tags

País: Spain

Región: EMEA

Event

ICE Barcelona 2026

19 de January 2026

Merkur Group Shines in Barcelona with Triple ICE Triumph

(Espelkamp/Barcelona).- Merkur Group secures three prestigious international accolades for operational excellence, social commitment, and standout exhibition experience.

Friday 06 Feb 2026 / 12:00

Eduardo Aching: "ICE 2026 was an exceptional event for Konami and its casino partners"

(Barcelona, SoloAzar Exclusive).- Eduardo Aching, Vice President of iGaming & International Gaming Operations at Konami Gaming, reflects on the company’s standout participation at ICE 2026, the strong reception to Solstice 49C and Konami Online Interactive, and the strategic push toward emerging regulated markets and expanded global partnerships.

Friday 06 Feb 2026 / 12:00

Belatra Games Strengthens LatAm Expansion and Innovation Strategy After ICE Barcelona 2026

(Barcelona, SoloAzar Exclusive).- Kateryna Goi, Chief Marketing Officer at Belatra Games, shares her assessment of the company’s participation in ICE Barcelona 2026, the quality of industry engagement at the event, and the strategic priorities shaping Belatra’s growth in 2026, with a strong focus on Latin America and narrative-driven innovation.

Friday 06 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.