United States: IRS-CI urges taxpayers to play with rules when it comes to sports betting

Monday 09 de September 2024 / 12:00

2 minutos de lectura

(Washington).-The 2024-2025 football season with nearly 50% of Americans having bet on sports at some point in time, IRS Criminal Investigation (IRS-CI) reminds U.S. taxpayers to wager safely and legally this football season.

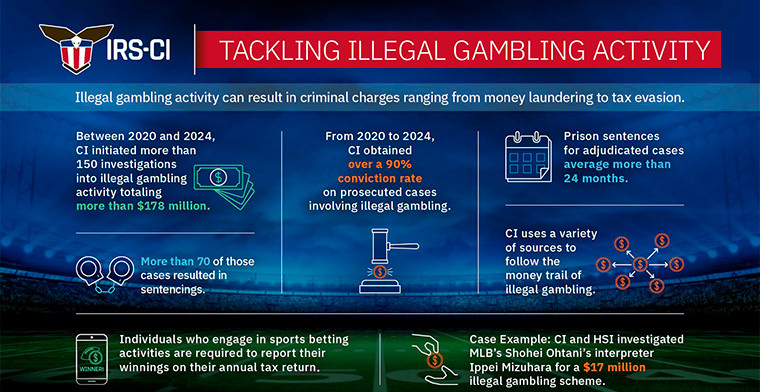

According to the American Gaming Association, nearly 68 million Americans, a 35% increase from 2023, wagered an estimated $23.1 million on last year’s Super Bowl. The annual revenue from the illegal sports betting market in the United States is estimated at more than $700 million. Between fiscal years 2020 and June 2024, IRS-CI initiated 151 investigations into illegal gambling activity totaling more than $178.8 million and resulting in 71 sentencings with an average prison term of over two years.

"Sports betting has grown exponentially in the past five years and is more common than ever. While online gambling is easily accessible, it’s not always legal," said IRS Criminal Investigation Chief Guy Ficco. "As this year’s football season kicks off, IRS-CI special agents are continuing to monitor trends and using our expertise to root out criminal activity related to illegal gambling like money laundering and tax evasion.”

Earlier this year, IRS-CI and Homeland Security Investigations special agents uncovered that Major League Baseball (MLB) player Shohei Ohtani’s former interpreter Ippei Mizuhara had engaged in gambling activity with an illegal bookmaking operation for several years. Mizuhara illegally transferred almost $17 million from Ohtani’s bank account – without the player’s knowledge or permission – to pay off his substantial gambling debts. From November 2021 to March 2024, Mizuhara used Ohtani’s password to successfully sign into the bank account and change the account’s security protocols, the registered email address and telephone number on the account so bank employees would call him – not Ohtani – when attempting verification. In furtherance of the scheme, Mizuhara impersonated Ohtani and used his personal identifying information to deceive the bank’s employees into authorizing wire transfers from the bank account. In total, Mizuhara called the bank and impersonated Ohtani on approximately 24 occasions.

In June 2023, several individuals were charged with owning or running illegal gambling businesses in Ohio, along with tax and other offenses such as money laundering. Two of the primary business owners, Christos Karasarides Jr. and Ronald DiPietro, tried to conceal their ownership of the illegal gambling businesses by using nominee owners and sham contracts. Additionally, their businesses made millions of dollars, but they had not reported any of the earnings on their tax returns. This summer, the pair was sentenced to 21 and more than nine years in prison, respectively, and ordered to pay millions of dollars in restitution for their roles in the illegal gambling operation.

Individuals who engage in sports betting activities are required to report their winnings on their annual tax return. Additionally, the IRS encourages individuals to keep detailed records of all gambling transactions, including bets placed, winnings received, and losses incurred.

Sports enthusiasts who are unsure about their tax obligations or have questions about reporting gambling income are encouraged to consult tax professionals or visit the official IRS website for guidance. Ignorance of the tax law does not exempt individuals from their responsibilities.

Categoría:E-Sports

Tags: Sin tags

País: United States

Región: North America

Event

ICE Barcelona 2026

19 de January 2026

Nadia Popova from EGT on ICE Barcelona 2026:"The new concept of our stand made a strong impression on visitors"

(Barcelona, SoloAzar Exclusive).- In this post-event interview from Barcelona, Nadia Popova, EGT’s Chief Revenue Officer and VP Sales & Marketing shares insights on the company’s standout presence, its “All eyes on us” stand concept, key product highlights, and the strategic partnerships forged at ICE Barcelona 2026.

Friday 20 Feb 2026 / 12:00

Luz Beatriz Jaramillo Serna of 21Viral: “Our presence at ICE Barcelona 2026 was exceptionally positive”

(Barcelona, SoloAzar Exclusive).- Following her participation at ICE Barcelona 2026, Luz Beatriz Jaramillo Serna, Head of Business Development, Marketing and Sales for Latin America at 21Viral, analyzes the commercial impact of the event, the trends set to shape the industry’s direction, and the company’s strategic priorities to consolidate growth across the region and new regulated markets.

Monday 16 Feb 2026 / 12:00

Toni Karapetrov from Habanero on ICE Barcelona 2026: Regulated Growth, Localization and Strategic Expansion Drive 2026 iGaming Strategy

(Barcelona, Exclusive SoloAzar).- In this interview, Toni Karapetrov, Head of Corporate Communications at Habanero, shares insights from ICE Barcelona 2026, highlighting premium content innovation, high-level industry engagement, key iGaming trends such as localization and gamification, and the company’s strategic focus on regulated market expansion and sustainable growth in 2026.

Friday 13 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.