Q1 Commercial Gaming Revenue Returns to Pre-Pandemic Growth Pattern

2 minutos de lectura

(Whashington).- This morning, we released our quarterly report on U.S. commercial gaming revenue, showing that Q1 2021 revenue reached $11.1B, matching Q3 2019 as the industry’s highest grossing quarter ever and marking a 4.4 percent increase from Q1 2019.

The full results of AGA’s full Q1 Commercial Gaming Revenue Tracker are below.

Even a few months ago, it would have been hard to predict that commercial gaming revenue would rebound to pre-pandemic highs so quickly. Despite a slow start to the year, March 2021 broke the all-time monthly revenue record for U.S. commercial gaming, and I’ve heard from many of you that April also trended in that positive direction.

The numbers for Q1 2021 show bright spots all around.

While the continued growth of sports betting and iGaming is contributing significantly to revenue growth, traditional casino gaming is also nearing pre-pandemic levels. In fact, multiple regional markets set new records in Q1, an impressive feat and a testament to our industry’s progress despite widespread restrictions on amenities and casino capacity.

We have worked hard to provide customers with an environment they can safely return to, and as a result, gaming remains a first-class entertainment destination for Americans all across the country.

I’m optimistic for the months ahead as increased vaccination rates spark the next phase of gaming’s recovery, easing COVID restrictions and bringing back of the invaluable conventions and events business.

While I’m certainly not ready to fly the "Mission Accomplished" banner, it’s clear that we are well on our way. And with the continued expansion of gaming across the U.S. giving us added opportunities for growth, I’ve never been more optimistic for our industry’s future.

One year after COVID-19 first shuttered the U.S. gaming industry, commercial casinos across the country are showing strong signs of recovery. During the first quarter, consumers began to emerge from COVID-induced isolation, boosted by increasing vaccination rates, an increasingly optimistic economic outlook and significant pent-up demand for travel and entertainment. Taken together, these factors propelled quarterly commercial gaming revenue to pre-pandemic levels.

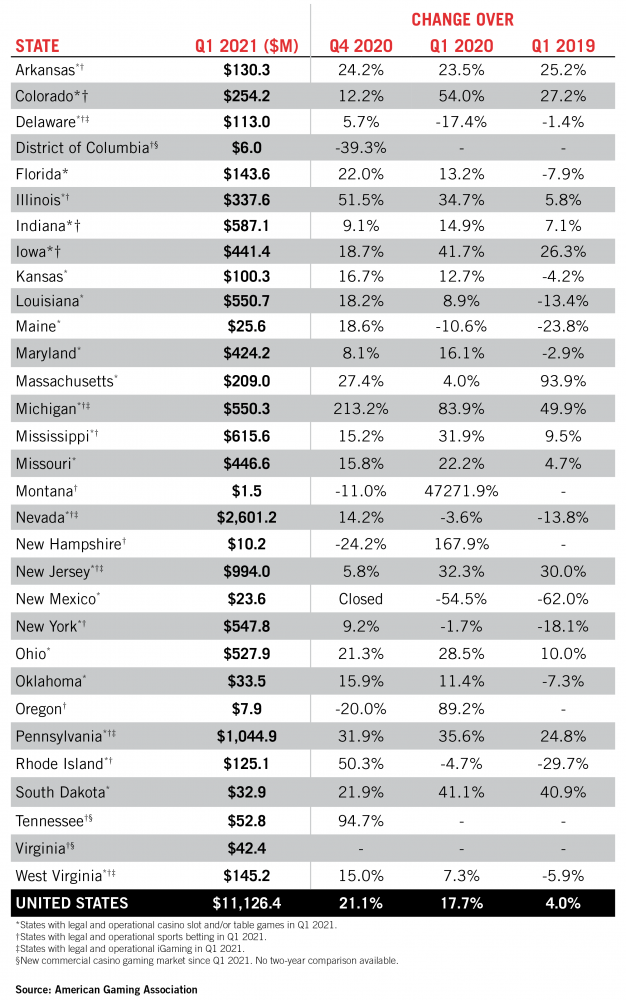

In the first quarter of 2021, commercial gaming revenue nationwide reached $11.13 billion, an increase of 17.7 percent from the same three-month period in 2020. More impressive: gaming revenue was up 4.0 percent from 2019 - within a tenth of a percent of the highest quarterly revenue total in the history of U.S. gaming.

While gaming revenue contracted year-over-year in January (-7.8%) and February (-14.6%), March revenue climbed to $4.48 billion, making it the highest grossing month ever in terms of gaming revenue, an increase of 12.9 percent compared to the previous all-time high monthly revenue from March 2019 ($4.00B).

Impressively, gaming outperformed the broader economy in the first quarter, as U.S. GDP jumped 6.4 percent on an annualized basis. But that only tells part of the gaming industry’s story. Though $11.13 billion was generated from gaming, casinos across the country continued to struggle with limitations on live entertainment, dining, hotel bookings and meetings and conventions that are essential to the industry’s bottom line.

On a consecutive quarterly basis, first quarter revenue was 21.1 percent higher than Q4 2020, driven by continued reopenings and strong overall consumer spending trends.

Some state-mandated closures persisted into the first quarter of this year. Casinos in Pennsylvania and Illinois were only allowed to reopen from a second mandated shutdown on January 4 and January 16, respectively. In early March, New Mexico became the last commercial gaming market to resume operations after having been shuttered for just shy of one year.

Once allowed to reopen, casinos in these states, along with the vast majority of gaming properties nationwide, had to operate with limited occupancy, game capacity and other amenities. Fourteen out of the 25 commercial casino states – home to approximately two-thirds (76.5%) of U.S. commercial properties – limited casino occupation to below 50 percent at any point during the quarter. Just three states (7.1% of commercial casinos) permitted casinos to operate at full capacity throughout the first quarter, while another three jurisdictions (11.0% of commercial casinos) lifted restrictions during this period.

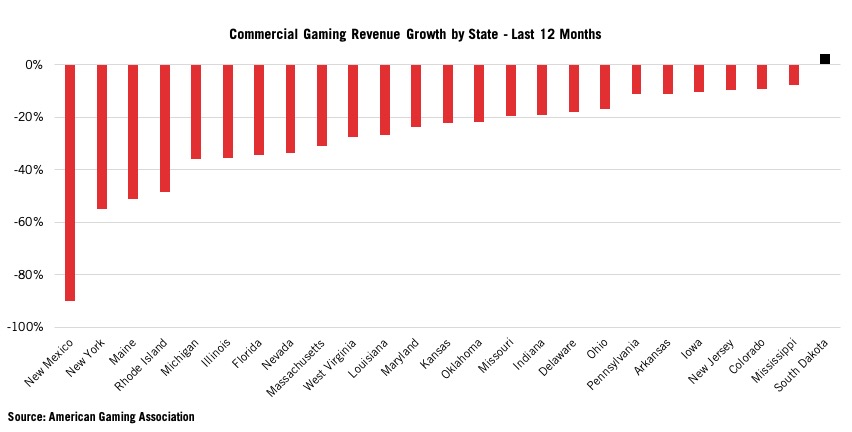

One of the few places where commercial casinos were operating at full capacity in the first quarter was South Dakota – the first commercial gaming state that reopened one year ago on May 7. Over the past year, Deadwood was the only casino market in the country where gaming revenue grew over the preceding 12-month period (+4.2%).

*Compares Q2 2020-Q1 2021 with Q2 2019-Q1-2020.

Current restrictions for commercial casino gaming can be accessed through the AGA’s COVID-19 Casino Tracker.

Despite the limitations, 14 out of 25 commercial casino states saw quarterly gaming revenue increase compared to the first quarter of 2019, including three of the four largest gaming states: New Jersey (+30.0%), Pennsylvania (+24.8%) and Indiana (+7.1%). Meanwhile, 12 markets reported their highest-ever levels of gaming revenue for a single month in March, including Arkansas, Colorado, Iowa, Maryland, Michigan, Missouri, Montana, Ohio, Oklahoma, Pennsylvania, South Dakota and Virginia.

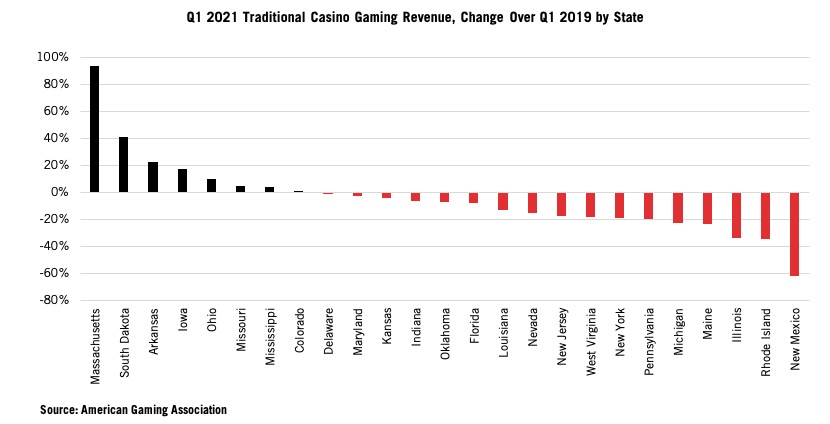

While sports betting and internet gaming have gotten a lot of attention over the last year, increased revenue generated from traditional land-based casino gaming powered growth in eight states.

Compared to Q1 2019, Massachusetts saw the most dramatic increase in traditional gaming revenue (93.9%) stemming from the opening of Wynn’s Encore Boston Harbor casino-resort in Q3 2019, while Arkansas’ growth (22.5%) can be attributed to the commencement of full casino gaming at the state’s existing racinos and the opening of Saracen Casino Resort in 2019. However, increases in traditional gaming revenue in South Dakota (40.9%), Iowa (17.0%), Ohio (10.0%), Missouri (4.7%), Mississippi (4.1%) and Colorado (0.2%) occurred without these markets experiencing any significant expansion in the last two years. Notably, most of these states operated throughout the quarter with reduced occupancy, number of slot machines in play and number of players that could be seated at any table game. In Colorado, table games were altogether suspended until mid-February.

Nationwide, gaming revenue from traditional casino gaming reached $9.37 billion in the first quarter of 2021, a 10.1 percent drop from Q1 2019, but a 19.8 percent increase over the last quarter of 2020.

The sports betting and internet gaming verticals, which have continued to rapidly expand during the COVID-19 pandemic, powered overall gaming revenue growth in Delaware, Indiana, Michigan, New Jersey and Pennsylvania compared to the same period in 2019.

In the first quarter of 2021, sports betting revenue reached $961.1 million, up 270.2 percent year-over-year and the highest-ever grossing quarter for legal wagering on sports. For context, that is more than the $908.8 million that was generated by sports betting nationwide in 2019. Americans bet more than $12.97 billion with legal sportsbook operators in the first three months of 2021, triple the handle from Q1 2020. March also set a record for the largest handle in a single month at $4.61 billion.

At the same time, internet gaming revenue reached $784.5 million during the quarter, more than tripling revenue from Q1 2020 and representing half of annual internet gaming revenue in 2020 ($1.55B).

Combined revenue from sports betting and internet gaming, which in Q1 2020 accounted for 5.2 percent of total gaming revenue, reached a share of 15.7 percent in Q1 2021 – the second highest level to date and only bested in Q2 2020 (20.3%), when most of the land-based casinos stood dormant. In many states, however, the sports betting and internet gaming share of total gaming revenue far exceeded the national level, accounting for approximately half of revenue in New Jersey and Michigan, the latter of which only launched internet gaming and mobile sports betting in late-January.

Categoría:Casino

Tags: Sin tags

País: United States

Event

ICE Barcelona 2026

19 de January 2026

Tomás Galarza: "This edition of ICE was especially relevant for ASAP"

(Barcelona, SoloAzar Exclusive). Following his participation in ICE Barcelona 2026, Tomás Galarza, a Political Science graduate and foreign trade expert at ASAP, shares his insights on global trends, international business opportunities, and the company's strategic priorities for this year.

Wednesday 04 Feb 2026 / 12:00

Win Systems Expands Presence in Spain and Highlights Route Operations at ICE 2026

(Barcelona).- At ICE 2026 in Barcelona, Win Systems showcased its innovative gaming solutions for the Spanish market, emphasizing Player Tracking, Win Pay, and route operations to enhance operator performance and player engagement.

Wednesday 04 Feb 2026 / 12:00

Spintec Showcases Next-Generation Electronic Table Games at ICE Barcelona 2026

(Volcja Draga).- Spintec reinforced its position as a leading innovator in electronic table games during ICE Barcelona 2026, standing out within The Merkur Group’s expansive exhibition through a diverse portfolio of immersive products focused on player comfort, dynamic gameplay and efficient use of gaming floor space.

Tuesday 03 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.