AGA issues statement on new legislation seeking to repeal federal tax on legal sports betting operators

Thursday 01 de August 2024 / 12:00

2 minutos de lectura

(Washington).-AGA Statement on New Legislation to Repeal the Federal Excise Tax on Legal Sports Betting Operators

American Gaming Association (AGA) President and CEO Bill Miller released the following statement on bipartisan legislation introduced today by Sen. Catherine Cortez Masto (D-NV) and Sen. Cindy Hyde-Smith (R-MS) that would repeal the federal sports betting excise tax on legal operators:

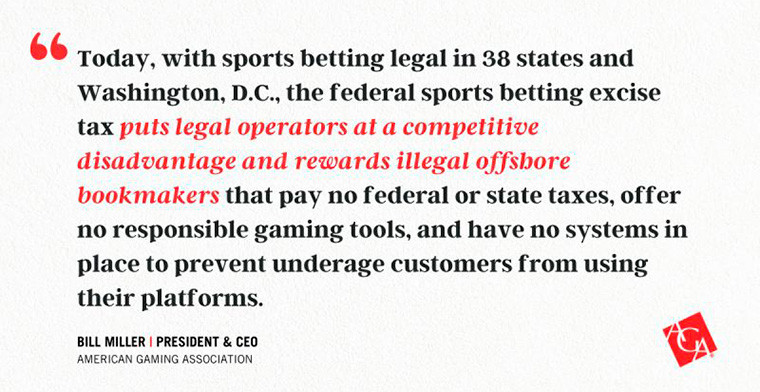

“The federal sports betting excise tax was enacted more than 70 years ago as a tool to prosecute illegal sports betting operators. Today, with sports betting legal in 38 states and Washington, D.C., this antiquated tax puts legal operators at a competitive disadvantage and rewards illegal offshore bookmakers that pay no federal or state taxes, offer no responsible gaming tools, and have no systems in place to prevent underage customers from using their platforms.

The AGA is grateful to Senators Cortez Masto and Hyde-Smith for their commitment to providing a safe, responsible sports betting market and to continuing to help migrate bettors out of the illegal market, which is bereft of consumer protections and a haven for bad actors and tax evaders. The AGA will continue to work with policymakers to enact legislation to address this harmful tax.”

Background

- The Internal Revenue Code currently imposes a federal excise tax of 0.25% on the amount of any legal sports wager, as well as an additional $50 annual head tax for every employee engaged in receiving wagers for or on behalf of any legal sports betting operator. This tax is applied to the amount wagered and not the revenue, unlike any other excise tax. Meanwhile, the $50 head tax on each sportsbook employee further discourages job creation.

- Established in 1951, the excise tax was never intended to be a revenue source, but rather a tool for prosecuting illegal bookmaking operations that did not pay the tax.

- Even before paying the federal excise tax, sportsbooks are low margin businesses with high operating costs including licensing fees, state taxes and other compliance expenses.

Categoría:Others

Tags: American Gaming Association,

País: United States

Región: North America

Event

ICE Barcelona 2026

19 de January 2026

Nadia Popova from EGT on ICE Barcelona 2026:"The new concept of our stand made a strong impression on visitors"

(Barcelona, SoloAzar Exclusive).- In this post-event interview from Barcelona, Nadia Popova, EGT’s Chief Revenue Officer and VP Sales & Marketing shares insights on the company’s standout presence, its “All eyes on us” stand concept, key product highlights, and the strategic partnerships forged at ICE Barcelona 2026.

Friday 20 Feb 2026 / 12:00

Luz Beatriz Jaramillo Serna of 21Viral: “Our presence at ICE Barcelona 2026 was exceptionally positive”

(Barcelona, SoloAzar Exclusive).- Following her participation at ICE Barcelona 2026, Luz Beatriz Jaramillo Serna, Head of Business Development, Marketing and Sales for Latin America at 21Viral, analyzes the commercial impact of the event, the trends set to shape the industry’s direction, and the company’s strategic priorities to consolidate growth across the region and new regulated markets.

Monday 16 Feb 2026 / 12:00

Toni Karapetrov from Habanero on ICE Barcelona 2026: Regulated Growth, Localization and Strategic Expansion Drive 2026 iGaming Strategy

(Barcelona, Exclusive SoloAzar).- In this interview, Toni Karapetrov, Head of Corporate Communications at Habanero, shares insights from ICE Barcelona 2026, highlighting premium content innovation, high-level industry engagement, key iGaming trends such as localization and gamification, and the company’s strategic focus on regulated market expansion and sustainable growth in 2026.

Friday 13 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.