Gaming Revenue Tracker state-by-state and nationwide, by AGA

Tuesday 22 de October 2024 / 12:00

2 minutos de lectura

(Washington).- The American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker features state-by-state and nationwide financial performance data with breakdowns for individual gaming verticals.

The American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker features state-by-state and nationwide financial performance data with breakdowns for individual gaming verticals.

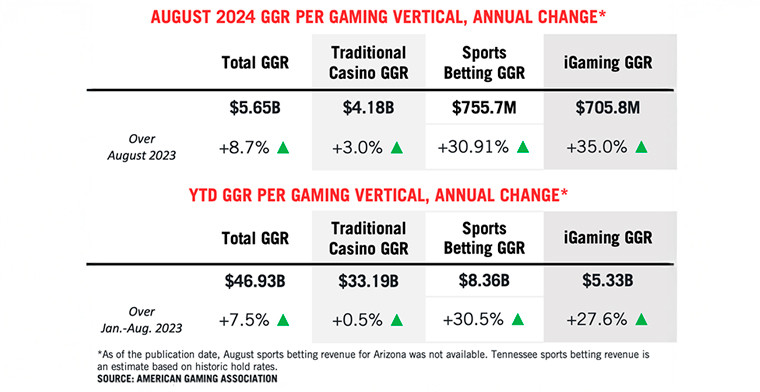

In August, U.S. commercial gaming revenue grew 8.7 percent compared to the same month in 2023, the industry’s 42nd consecutive month of annual growth. According to data from state regulators compiled by the American Gaming Association (AGA), industry win from traditional casino games, sports betting and iGaming reached $5.65 billion, setting a new monthly high for August.

Through the first eight months of 2024, commercial gaming revenue stands at $46.93 billion, 7.5 percent higher than the same period last year.

Nationwide, the legal casino gaming, sports betting and iGaming verticals generated $1.21 billion in state gaming tax revenue in August. Over the first eight months of year, regulated gaming operators have paid $10.14 billion in gaming taxes alone.

Of the 34 commercial gaming jurisdictions that were operational a year ago and had published complete August data, 32 reported an increase in combined revenue from traditional casino games, sports betting and iGaming with only Nevada (-3.8%) and South Dakota (-4.2%) contracting.

Sports betting revenue data was not yet available for Arizona at the time of writing.

Land-based gaming, including combined revenue from casino slots, table games and retail sports betting increased by 3.3 percent year-over-year to $4.22 billion in August.

At the same time, online gaming continued its strong expansion with combined revenue from online sports betting and iGaming jumping 28.8 percent year-over-year to $1.42 billion. In August, online gaming accounted for 25.2 percent of total commercial gaming revenue compared to 21.3 percent in August 2023.

Traditional casino slot machines and table games continue to comprise the bulk of revenue for the U.S. commercial gaming industry. In August, these segments collectively generated $4.18 billion in total revenue, a healthy 3.0 percent expansion over last August. Slot machines generated $3.05 billion, up 3.4 percent, while table game revenue remained relatively flat, growing by .14 percent to $823.6 million.

These individual slot and table game figures exclude data from Louisiana and Michigan due to different state reporting methods, but their combined totals are included in the nationwide traditional gaming total.

Traditional gaming revenue bounced back in August after falling nearly five percent in July: 22 of the 27 states with traditional casino gaming reporting expanded brick-and-mortar revenue compared to August 2023.

Through the end of August, year-to-date revenue from casino slot machines and table games totaled $33.19 billion, 0.5 percent ahead of the same period in 2023. The limited traditional gaming growth year-to-date is largely driven by new casino openings or emerging markets in Illinois, Indiana, Virginia and Nebraska. Notably, Lincoln, Nebraska’s WarHorse Casino opened in mid-August driving Nebraska’s exceptionally strong annual growth.

In August, land-based and online sportsbooks generated a combined $755.7 million in commercial revenue across 33 jurisdictions, excluding Arizona, which had not reported data at the time of publication. This represents a 30.9 percent increase from August 2023, when commercial sports betting was active in 30 jurisdictions.

Since last August, four new states have launched commercial sports betting: Kentucky, Maine, North Carolina and Vermont. Excluding the impact of new sports betting markets, organic sports betting revenue grew by 21.5 percent compared to August 2023.

August sports betting revenue in the District of Columbia grew 333 percent year-over-year in August due to its online sports betting market expanding to include additional non-lottery operators. Delaware sports betting revenue grew 126 percent, still benefiting from the relatively recent launch of online betting less than a year ago.

Year-to-date, commercial sports betting revenue reached $8.36 billion through August, exceeding the same period last year by 30.4 percent.

The iGaming sector continued its strong growth in August as revenue expanded 35.0 percent year-over-year to $705.8 million across seven active states.

State-level revenue increased in all six states where iGaming was active in August 2023. Notably, Delaware iGaming revenue increased 419.4 percent in August, a result of a recent shift in the state’s iGaming partner.

Year-to-date through August, iGaming revenue reached $5.33 billion, a 27.6 percent increase compared to the same month last year.

About the Report

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and nationwide insight into the U.S. commercial gaming industry’s financial performance. Monthly updates on AmericanGaming.org feature topline figures based on state revenue reports while quarterly reports provide a more detailed analysis covering the three previous months.

Categoría:Reports & Data

Tags: Sin tags

País: United States

Región: North America

Event

ICE Barcelona 2026

19 de January 2026

NOVOMATIC 2026: Global Expansion and Comprehensive Strategy in the Gaming Industry

(Barcelona, SoloAzar Exclusive).- NOVOMATIC AG kicked off 2026 with strong momentum, underscored by its standout presence at ICE Barcelona. Thomas Schmalzer, VP of Global Sales and Product Management, highlighted the company’s presentation of its integrated 360-degree portfolio—spanning cabinets, gaming content, and system solutions—while reinforcing global partnerships and advancing into new markets.

Friday 06 Mar 2026 / 12:00

Nadia Popova from EGT on ICE Barcelona 2026:"The new concept of our stand made a strong impression on visitors"

(Barcelona, SoloAzar Exclusive).- In this post-event interview from Barcelona, Nadia Popova, EGT’s Chief Revenue Officer and VP Sales & Marketing shares insights on the company’s standout presence, its “All eyes on us” stand concept, key product highlights, and the strategic partnerships forged at ICE Barcelona 2026.

Friday 20 Feb 2026 / 12:00

Luz Beatriz Jaramillo Serna of 21Viral: “Our presence at ICE Barcelona 2026 was exceptionally positive”

(Barcelona, SoloAzar Exclusive).- Following her participation at ICE Barcelona 2026, Luz Beatriz Jaramillo Serna, Head of Business Development, Marketing and Sales for Latin America at 21Viral, analyzes the commercial impact of the event, the trends set to shape the industry’s direction, and the company’s strategic priorities to consolidate growth across the region and new regulated markets.

Monday 16 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.