MGC Publishes April 2025 Casino and Sports Betting Revenue Report

Wednesday 21 de May 2025 / 12:00

2 minutos de lectura

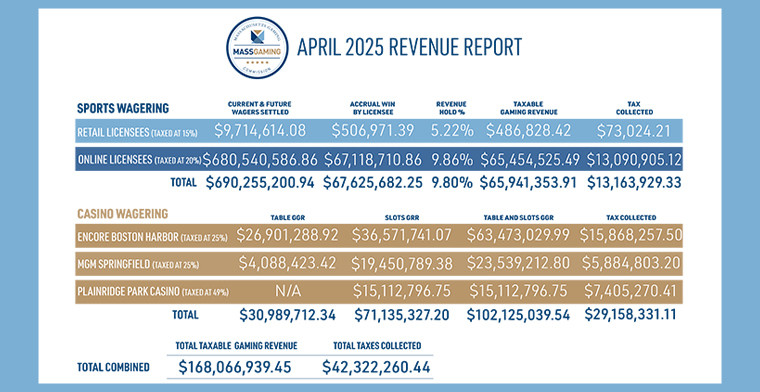

(Massachusetts).- The Massachusetts Gaming Commission released its April 2025 gaming revenue report, revealing that three major casinos generated $102.12 million in GGR.

The Massachusetts Gaming Commission (MGC) has released its April 2025 gaming revenue report, highlighting continued growth in both casino operations and sports wagering across the state.

Casino Revenue Surpasses $102 Million

Massachusetts casinos—Plainridge Park Casino (PPC), MGM Springfield (MGM), and Encore Boston Harbor (EBH)—generated $102.12 million in Gross Gaming Revenue (GGR) in April. These facilities continue to drive strong returns, contributing significantly to state funds through gaming taxes.

PPC, classified as a Category 2 slots facility, is taxed at 49% of its GGR, with 82% allocated to Local Aid and 18% directed to the Race Horse Development Fund. Meanwhile, Category 1 resort-casinos—MGM Springfield and Encore Boston Harbor—are taxed at 25%, with revenue distributed among multiple state programs.

Since the opening of Massachusetts casinos, the Commonwealth has collected approximately $2.074 billion in gaming taxes and assessments.

Sports Betting Revenue Exceeds $65 Million

The state's sports wagering industry continues to gain momentum. In March 2025, seven mobile/online sports betting operators and three retail sportsbooks reported $65.94 million in taxable sports wagering revenue (TSWR).

Retail sportsbooks (operated by EBH, MGM, and PPC) are classified as Category 1 Sports Wagering Operators and taxed at 15% of TSWR. Meanwhile, Category 3 operators—including Bally Bet, BetMGM, Caesars Sportsbook, DraftKings, ESPNBet, Fanatics Betting & Gaming, and FanDuel—run mobile/online sportsbooks and are taxed at 20%.

State Allocation of Sports Betting Taxes

Massachusetts distributes sports betting tax revenue across various state funds:

- 45% to the General Fund

- 17.5% to the Workforce Investment Trust Fund

- 27.5% to the Gaming Local Aid Fund

- 1% to the Youth Development and Achievement Fund

- 9% to the Public Health Trust Fund

Since the launch of sports betting in Massachusetts—retail betting on January 31, 2023, and online betting on March 10, 2023—the Commonwealth has collected approximately $267.60 million in total taxes and assessments from licensed operators.

Regulations on Negative Revenue Adjustments

Under Massachusetts law, if an operator reports negative adjusted gross sports wagering receipts due to high payout winnings or federal excise taxes, the Sports Wagering Law permits carrying over negative tax liabilities to subsequent months. This ensures financial stability for operators while maintaining tax contributions.

Categoría:Reports

Tags: Sin tags

País: United States

Región: North America

Event

ICE Barcelona 2026

19 de January 2026

Daniel De Los Ríos on Amusnet’s ICE Barcelona 2026 Experience and LATAM Growth Plans

(Barcelona, SoloAzar Exclusive).- The Head of Commercial and Marketing in LATAM at Amusnet shares insights on the company’s latest innovations, industry trends, and strategic goals for 2026.

Thursday 05 Feb 2026 / 12:00

Tomás Galarza: "This edition of ICE was especially relevant for ASAP"

(Barcelona, SoloAzar Exclusive). Following his participation in ICE Barcelona 2026, Tomás Galarza, a Political Science graduate and foreign trade expert at ASAP, shares his insights on global trends, international business opportunities, and the company's strategic priorities for this year.

Wednesday 04 Feb 2026 / 12:00

Win Systems Expands Presence in Spain and Highlights Route Operations at ICE 2026

(Barcelona).- At ICE 2026 in Barcelona, Win Systems showcased its innovative gaming solutions for the Spanish market, emphasizing Player Tracking, Win Pay, and route operations to enhance operator performance and player engagement.

Wednesday 04 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.