Online gambling market: this is the 3rd quarterly report in Spain

Monday 09 de December 2024 / 12:00

2 minutos de lectura

(Madrid).-The 3rd quarterly report on the evolution of the online gambling market for the period July-September 2024 is published.

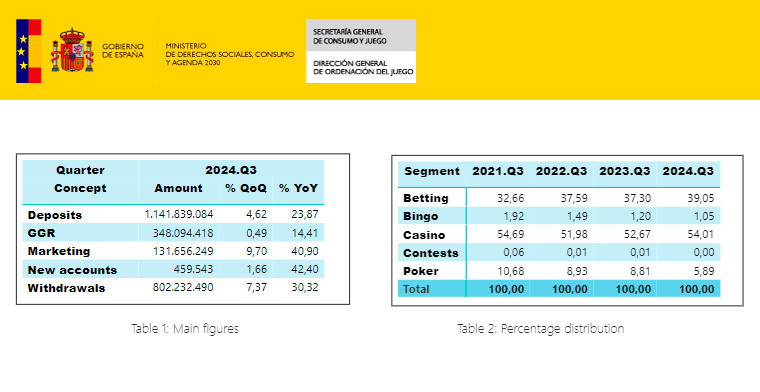

The GGR for the quarter was € 348.09 million, an increase of 0.49% quarter over quarter and 14.41% year over year.

Regarding the rest of the main figures, deposits and withdrawals of the players, their variation rates rise in relation to the previous year, 23.87% and 30.32% respectively. With regard to previous quarter, deposits increased 4.62% and withdrawals 7.37%. Marketing expenditure increase 9.70% quarter over quarter and new accounts experiences a growth with respect to the previous quarter, 1.66%. Details are shown in Table 1.

In the analysis of the GGR by game segments, it is observed that:

The € 348.09 million of GGR are distributed among € 135.92 million in Betting (39.05%); € 3.67 million in Bingo (1.05%); € 187.99 million in Casino (54.01%); € 0.00 million in Contests (0.00%) and € 20.52 million in Poker (5.89%).

The betting segment had a negative variation rate of -6.57% quarter over quarter and a positive variation 19.76% year over year. There was a decrease with respect to the previous quarter in pre-match, -24.26% and an increase of in-played sportsbook, 8.74%. Other bettings increased by 20.88% this quarter, and horse betting decreases by -22.03%.

Bingo has experienced a growth of 1.71% quarter over quarter and 0.67% year over year.

In the casino segment, there has been a growth of 9.45% quarter over quarter and an annual variation rate of 17.30%. Slots has increased 25.80%, Black Jack, 49.39% and life roulette 4.68% year over year. Quarter over quarter, Conventional Roulette increased by 7.01% live roulette by 0.63%, slot machines by 13.69% and Black Jack by 12.38%.

Contests has very little activity

Poker presents a fall of -19.73% quarter over quarter and -23.47% year over year. Poker tournament had a negative variation rate of -28.99% quarter over quarter and -27.02% year over year. Poker cash increased 15.42% compared to the previous quarter and decreased -13.68% compared to the same quarter of the previous year.

As a summary, the percentage distribution of the GGR for the different segments in this quarter of the period from 2021 to 2024 is shown in Table 2.

Marketing expenses has been € 131.66 million in the last quarter. It may be broken down into € 13.16 million affiliation expenses; € 1.26 million sponsorship; promotions € 66.84; and advertising € 50.40 million. Marketing expenses increases 9.70% quarter over quarter and 40.90% year over year.

Quarter over quarter, Sponsorship increased 4.49%; Affiliate 2.69%; Promotions, 7.70%; Advertising, 14.62%. Year over year, Sponsorship increased 44.50%; Affiliates, 13.71%; Advertising, 51.28% ; Promotions, 40.18%. Promotions are broken down into cost of bonus included in prizes, € 21.21 million and cost of bonus not included in prizes, € 45.63 million.

The monthly average of active game accounts is 1,443,615; which implies an increase of 3.02% quarter over quarter and an increase of 33.33% year over year. The monthly average of the new game accounts is 153,181; with a growth of 1.66% quarter over quarter and 42.40% year over year.

For this quarter, there are 77 licensed operators and the number of active operators by segment is:

- Betting: 42

- Bingo: 4

- Casino: 51

- Contests: 2

- Poker: 9

Categoría:Reports

Tags: DGOJ,

País: Spain

Región: EMEA

Event

ICE Barcelona 2026

19 de January 2026

CT Gaming Shines at ICE Barcelona 2026

(Sofia).- At ICE Barcelona 2026, CT Gaming showcased its latest multigame products, attracting strong operator interest and confirming its global market leadership.

Wednesday 28 Jan 2026 / 12:00

Konami Online Interactive debuted at ICE as a new iGaming brand and Solstice 49C™ was unveiled

(Las Vegas).- We present a Complete summary of Konami products after the ICE Barcelona 2026 event, highlighting the main innovations and trends presented at Fira Barcelona Gran Via.

Wednesday 28 Jan 2026 / 12:00

Soft2Bet Wins Two Major Industry Awards at ICE Barcelona 2026

(Malta).- Soft2Bet secured two prestigious accolades at the Global Gaming Awards EMEA and the International Gaming Awards, taking home Platform Provider of the Year and Innovator of the Year honors.

Wednesday 28 Jan 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.