Washington weighs plan to let Americans wager on elections

Monday 12 de September 2022 / 07:10

2 minutos de lectura

(Washington).- Officials at the CFTC, the regulator in charge of overseeing U.S. derivatives markets, have long been reluctant to open up trading in elections.

Kalshi Inc. may become the New York Stock Exchange of U.S. elections. It just needs to get past federal regulators first. The up-and-coming prediction market operator, backed by some of the biggest names on Wall Street and Silicon Valley, is already a force in launching new contracts for investors and bettors to trade on everything from climate change to potential Moon landings.

Yet Kalshi’s latest planned market — focused on which political party will control Congress in the new year — is sparking a debate in Washington.

Under the proposal, Kalshi wants to list two new so-called political event contracts based on the question of whether Democrats or Republicans will take over each chamber after the midterms. Investors would be able to wager as much as $25,000 on the outcomes of the elections.

Officials at the Commodity Futures Trading Commission, the regulator in charge of overseeing U.S. derivatives markets, have long been reluctant to open up trading in elections. In 2012, the CFTC rejected a similar bid by the North American Derivatives Exchange, or Nadex. The regulator was concerned that the products effectively represented a form of gambling, that they could influence the outcomes of the races themselves, and were ultimately not in the public interest.

Now, it has to decide whether Kalshi’s proposal will meet the same fate.

“When we think about what happened in 2020, do we really want another excuse for the American people to question the integrity of our elections?” said former CFTC Commissioner Jill Sommers, who voted against the Nadex proposal. “This is not something we want to be introducing into federally regulated financial markets.”

Americans are not new to election markets, with betting going back well over 150 years, according to Koleman Strumpf, an economics professor at Wake Forest University who researches prediction markets. In the 1916 presidential election alone, the equivalent of more than $276 million in today’s dollars was wagered, according to a paper by Strumpf and University of Michigan economics professor Paul Rhode.

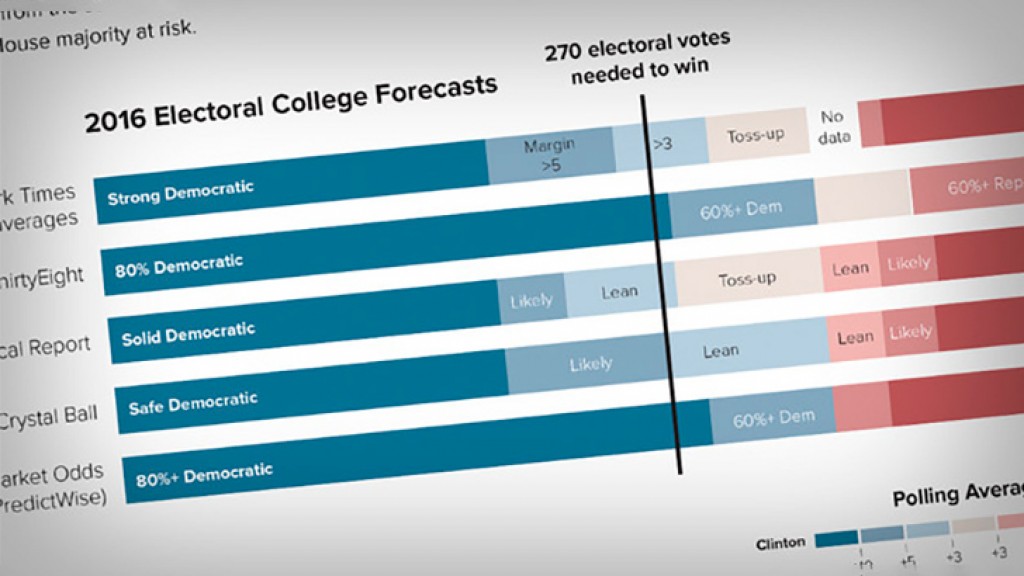

In the modern era, the allure of political prediction markets has only swelled, and not just with Wall Street traders, political junkies and bettors. Academics, journalists and pollsters themselves have latched onto the space for any hints as to how Americans are leaning at the voting booth. A number of different venues have popped up as a result to offer ways — not all legal — to trade on elections as big as the race for the White House and as local as contests to take over the mayor’s mansion. The now-shuttered Irish prediction market Intrade did so for years before the CFTC filed charges against it in 2012 for allowing U.S. customers to trade options products in the form of prediction contracts to U.S. customers despite the regulator’s ban on off-exchange options trading.

Others such as academic-backed markets PredictIt and the Iowa Electronic Markets have been able to offer political event contracts under limitations the CFTC set for them in return for not having to register with the agency. However, in August, the commission determined that PredictIt was in violation of those terms and essentially ordered it to wind down by February 2023.

“People have been interested in betting on elections as long as the country has had elections,” Strumpf said. “There’s always been an underground tradition in the U.S.”

Kalshi says it wants to change that by bringing political prediction trading into the light.

The New York-based startup is already registered with the CFTC as a designated contract market, a regulatory classification that puts Kalshi in the same bucket as historic derivatives exchanges like the CME Group-owned Chicago Mercantile Exchange and the former New York Board of Trade, known today as ICE Futures U.S.

So Kalshi executives argue that political trading on its venue would mean better oversight, protection and safeguards than today’s incumbents — possibly opening up political betting markets to far more people. Launched in 2021, Kalshi, which counts Sequoia Capital, Charles Schwab’s eponymous founder and private equity legend Henry Kravis among its investors, frames its eclectic array of markets as a new wave of hedging tools, no matter how unusual they may seem.

Think of a local restaurant, for instance. The owners, perhaps concerned about facing another pandemic-induced shutdown, could use Kalshi’s Covid-19 contracts to hedge against the possible loss in business. Its push into political markets is no different, CEO Tarek Mansour said.

“Everyday Americans are always exposed to election risks,” Mansour said, citing tax policy as an example of how Congress’ makeup hits investors big and small. “We are trying to bring these tools to the masses. You’re basically financially hedging a variety of different things in your life instead of just sitting down and thinking, ‘OK, this is just going to make my next four years worse.’”

Questions about the extent to which Kalshi’s contracts can be used as a hedge will be front and center for the CFTC as it weighs the proposal.

The regulator is specifically looking at two key issues, Willkie Farr & Gallagher partner Neal Kumar said. The first is whether the products involve a form of gaming, a classification of event contracts that is prohibited under CFTC rules along with the other types of unlawful activity.

The second is, if the contracts are determined to reference gaming, is there an economic purpose behind them such as providing a way for investors to hedge risk, Kumar said.

It’s a similar calculus that the regulator took a decade ago when reviewing Nadex’s political event contracts, which it determined were both a form of gaming and not in the public interest. But plenty has changed in 10 years.

Voter turnout has soared. Misinformation is now rampant online. And sports betting has proliferated across the country.

What’s more, in 2012, the regulator raised concern about the possible effect that Nadex’s political prediction markets could have on elections. But PredictIt has faced little concern along those lines despite operating for eight years and handling about 110 million contracts traded on questions about political control since the 2018 election cycle alone, Kalshi board member Tim McDermott said.

Categoría:Sportsbook

Tags: Sin tags

País: United States

Event

ICE Barcelona 2026

19 de January 2026

Merkur Group Shines in Barcelona with Triple ICE Triumph

(Espelkamp/Barcelona).- Merkur Group secures three prestigious international accolades for operational excellence, social commitment, and standout exhibition experience.

Friday 06 Feb 2026 / 12:00

Eduardo Aching: "ICE 2026 was an exceptional event for Konami and its casino partners"

(Barcelona, SoloAzar Exclusive).- Eduardo Aching, Vice President of iGaming & International Gaming Operations at Konami Gaming, reflects on the company’s standout participation at ICE 2026, the strong reception to Solstice 49C and Konami Online Interactive, and the strategic push toward emerging regulated markets and expanded global partnerships.

Friday 06 Feb 2026 / 12:00

Belatra Games Strengthens LatAm Expansion and Innovation Strategy After ICE Barcelona 2026

(Barcelona, SoloAzar Exclusive).- Kateryna Goi, Chief Marketing Officer at Belatra Games, shares her assessment of the company’s participation in ICE Barcelona 2026, the quality of industry engagement at the event, and the strategic priorities shaping Belatra’s growth in 2026, with a strong focus on Latin America and narrative-driven innovation.

Friday 06 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.