Las Vegas Sands Reports Fourth Quarter 2021 Results

2 minutos de lectura

(Las Vegas).- Las Vegas Sands Corp., the world's leading developer and operator of convention-based Integrated Resorts, today reported financial results for the quarter ended December 31, 2021.

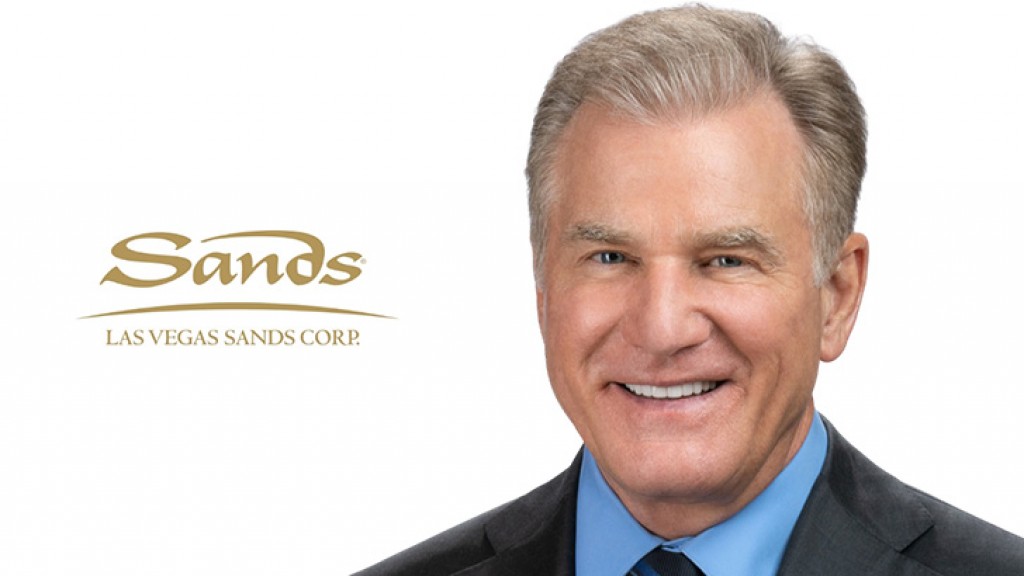

"We remain confident in the eventual recovery in travel and tourism spending across our markets and enthusiastic about the opportunity to welcome more guests back to our properties in 2022 and the years ahead," said Robert G. Goldstein, chairman and chief executive officer. "While pandemic-related travel restrictions continue to impact our current financial performance, we again generated positive EBITDA in each of our markets. We remain deeply committed to supporting our team members and to helping those in need in each of our local communities as they recover from the impact of the pandemic."

"Our ongoing investments in our team members, our communities and our market-leading Integrated Resort offerings position us exceedingly well to deliver growth as travel restrictions eventually subside and the recovery comes to fruition. We are fortunate that our financial strength supports our investment and capital expenditure programs in both Macao and Singapore, as well as our pursuit of growth opportunities in new markets."

Net revenue was $1.01 billion, a decrease of 0.7% from the prior year quarter. Operating loss was $138 million, compared to operating loss of $119 million in the prior year quarter. Net loss in the fourth quarter of 2021 was $315 million, compared to net loss of $303 million in the fourth quarter of 2020. Consolidated adjusted property EBITDA was $251 million, compared to $191 million in the prior year quarter.

Full year 2021 operating loss was $689 million, compared to operating loss of $1.39 billion in 2020. Net loss attributable to Las Vegas Sands was $961 million, or $1.26 per diluted share, in 2021, compared to net loss of $1.69 billion, or $2.21 per diluted share, in 2020.

In March 2021, LVS entered into definitive agreements to sell its Las Vegas real property and operations for an aggregate purchase price of approximately $6.25 billion and anticipates the transaction to close in the first quarter of 2022. The financial position, results of operations and cash flows of the Las Vegas Operating Properties have been presented as a discontinued operation held for sale.

Sands China Ltd. Consolidated Financial Results

On a GAAP basis, total net revenues for SCL decreased 4.3%, compared to the fourth quarter of 2020, to $643 million. Net loss for SCL was $245 million, compared to $246 million in the fourth quarter of 2020.

On a GAAP basis, full year 2021 total net revenues for SCL increased 70.4%, compared to the full year 2020, to $2.87 billion. Net loss for SCL was $1.05 billion in 2021, compared to $1.52 billion in 2020.

Other Factors Affecting Earnings

Interest expense, net of amounts capitalized, was $152 million for the fourth quarter of 2021, compared to $147 million in the prior year quarter. Our weighted average debt balance increased compared to the prior year quarter due to borrowings under the SCL Credit Facility during 2021, while our weighted average borrowing cost in the fourth quarter of 2021 was 4.2%, compared to 4.3% during the fourth quarter of 2020.

Our income tax expense for the fourth quarter of 2021 was $14 million, compared to $28 million in the prior year quarter. The income tax expense for the fourth quarter of 2021 was driven by a non-cash expense of $12 million related to an increase in the valuation allowance related to our U.S. foreign tax credits and a 17% statutory rate on our Singapore operations.

Balance Sheet Items

Unrestricted cash balances as of December 31, 2021 were $1.85 billion.

The company has access to $3.68 billion available for borrowing under our U.S., SCL and Singapore revolving credit facilities, net of outstanding letters of credit.

As of December 31, 2021, total debt outstanding, excluding finance leases and financed purchases, was $14.77 billion.

Capital Expenditures

Capital expenditures during the fourth quarter totaled $188 million, including construction, development and maintenance activities of $140 million in Macao, $46 million at Marina Bay Sands and $2 million in Corporate and Other.

Conference Call Information

The company will host a conference call to discuss the company's results on Wednesday, January 26, 2022 at 1:30 p.m. Pacific Time. Interested parties may listen to the conference call through a webcast available on the company's website at www.sands.com.

Categoría:Casino

Tags: Sin tags

País: United States

Event

ICE Barcelona 2026

19 de January 2026

Daniel De Los Ríos on Amusnet’s ICE Barcelona 2026 Experience and LATAM Growth Plans

(Barcelona, SoloAzar Exclusive).- The Head of Commercial and Marketing in LATAM at Amusnet shares insights on the company’s latest innovations, industry trends, and strategic goals for 2026.

Thursday 05 Feb 2026 / 12:00

Tomás Galarza: "This edition of ICE was especially relevant for ASAP"

(Barcelona, SoloAzar Exclusive). Following his participation in ICE Barcelona 2026, Tomás Galarza, a Political Science graduate and foreign trade expert at ASAP, shares his insights on global trends, international business opportunities, and the company's strategic priorities for this year.

Wednesday 04 Feb 2026 / 12:00

Win Systems Expands Presence in Spain and Highlights Route Operations at ICE 2026

(Barcelona).- At ICE 2026 in Barcelona, Win Systems showcased its innovative gaming solutions for the Spanish market, emphasizing Player Tracking, Win Pay, and route operations to enhance operator performance and player engagement.

Wednesday 04 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.