Industry generates more than US$ 7B in gaming tax revenue through H1 2023

Thursday 17 de August 2023 / 12:00

2 minutos de lectura

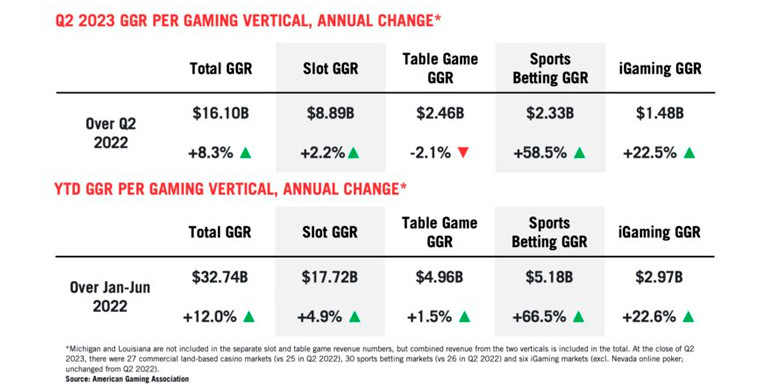

(Washington).- Following an exceptional Q1 which saw more than 16 percent annual growth in gaming revenues, U.S. commercial gaming revenue growth slowed significantly in the second quarter. Despite the decelerating rate of growth, nationwide gaming revenue nevertheless expanded by 8.3 percent year over year in Q2, surpassing $16 billion for a consecutive second quarter.

Quarterly Gaming Revenue Again Surpasses $16 Billion

Data compiled by the American Gaming Association shows that revenue from commercial gaming, encompassing traditional casino games, sports betting and iGaming, reached $16.10 billion, marking the industry’s second highest-grossing quarter ever and the tenth consecutive quarter of annual growth.

After the highest grossing first half of a year in its history, the commercial gaming sector is in a strong position for another record-setting year, despite increasingly difficult annual comparisons in the second half. Through June, gaming revenue was pacing 12.0 percent ahead of the same period in 2022, totaling $32.74 billion.

Land-based Revenue Stabalizes, Overall Growth Driven by Online

In Q2, the growth in total gaming revenue was again fueled by the online gaming verticals – particularly online sports betting – while land-based gaming was relatively flat.

Quarterly revenue generated by land-based gaming – casino slots, table games and retail sports betting – reached $12.38 billion, essentially flat from Q1 (-0.3%). Annual growth slowed to 0.9 percent, down from a pace of 7.0 percent in Q1 and 1.6 percent in Q4 2022. Conversely, online gaming revenue surged 43.1 percent year-over-year as online sports betting and iGaming revenue reached $3.68 billion. Online revenue expansion was mainly driven by the introduction of online sports betting in Kansas, Maryland, Massachusetts and Ohio within the past year.

Although a lighter sports betting calendar led to a sequential decline in the online share of overall gaming revenue from Q1, online sports betting and iGaming still accounted for 22.9 percent of quarterly commercial gaming revenue.

Growth in Tax Revenue Outpacing Gaming Win

The expansion of gaming revenue has led to a windfall in taxes for state and local governments in commercial gaming states. In Q2, commercial gaming operations paid an estimated $3.62 billion in direct gaming taxes to state and local governments. Estimated Q2 gaming tax revenue growth of 9.6 percent outpaced the 8.1 percent growth in gaming revenue. This is reflective of quarterly growth that was dominated by sports betting and iGaming – verticals that are on average subjected to higher tax rates.

At the halfway point, the gaming industry is on track to generate more gaming tax revenue for state and local governments in 2023 than in any previous year. The approximately $7.28 billion in gaming taxes paid during the first six months is 12.9 percent ahead of the same period in 2022.

Note that these tax figures only cover specific state and local taxes directly linked to gaming revenue. They do not encompass the billions of dollars paid by the industry in the form of income taxes, sales taxes or various corporate taxes, nor does it incorporate the payroll taxes paid by gaming operators and suppliers. Federal excise tax payments made by sports betting operators are also excluded from the total.

Most States Accelerate Year-over-year, 30 on Pace to Surpass 2022

At the state level, 23 of 34 commercial gaming jurisdictions that were operational one year ago increased Q2 revenue from 2022. Among gainers, two states – Massachusetts and Virginia – marked all-time records for a single quarter due to the recent inception of sports betting and land-based casino respectively.

Florida, Indiana, Iowa and Mississippi reported quarterly revenue contraction of between -1.6 and -6.2 percent, while Washington, D.C. dropped -9.1 percent as the small sports betting-only market continued to lose ground to neighboring Maryland and Virginia. Other states with revenue declines in Q2 fell by less than a percent.

Through June, 30 of 34 commercial gaming jurisdictions are on pace to exceed 2022 revenue totals, with only three states trailing last-year’s H1 performance: Florida, Indiana and Mississippi.

Resorts World NYC Leads Non-Nevada Casinos

At the property level, nine out of the top 20 highest grossing commercial casinos outside of Nevada reported that land-based gaming revenue expanded compared to the second quarter of 2022.Sequentially, the top three grossing casinos maintained their positions from Q1, while Atlantic City’s Borgata Casino leapfrogged Live! Casino in Maryland to secure the number four position. Hollywood at Charles Town, situated in West Virginia, surged five places up the rankings and Ocean Casino in Atlantic City and Golden Nugget Lake Charles in Louisiana both advanced by three positions.

Traditional Gaming Revenue Nearly Ties Quarterly Record

Boosted by the opening of new commercial casinos in Illinois, Nebraska and Virginia, traditional casino gaming generated quarterly revenue of $12.27 billion from slot machines and table games in Q2. Second quarter revenue from traditional land-based gaming grew 0.9 percent year-over-year while falling just short of the single-quarter record set in Q1 (-0.3%).

Casino slot machine revenue increased 2.2 percent year-over-year, reaching a new quarterly high of $8.89 billion. Table game revenue settled at $2.46 billion, a 2.1 percent drop from last year largely due to significant declines in table game revenue in Indiana, Mississippi and Ohio. The separate slot and table game figures do not include data from Louisiana and Michigan, though their aggregates are captured in the combined figure.

At the state level, of the 25 states that offered traditional casino gaming a year ago, 12 states increased combined revenue from slot and table games during the second quarter. Through the first half of 2023, traditional casino revenue showed year-over-year growth in 20 out of 25 states, while five states saw declines.

In Mississippi, the slowdown continues to be most pronounced in the Northern region, where traditional gaming revenue contracted by -13.3 percent during H1. This compares with more muted declines in the state’s Central (-3.5%) and Coastal (-1.9%) regions. Serving an increasingly competitive Memphis area, Mississippi’s northern casinos continue to lose shares in the Memphis market to Southland Casino across the Arkansas border which saw traditional gaming revenue surge 19.3 percent in H1 and is now one of the highest grossing casino properties in the country outside of Nevada.

In Louisiana, the New Orleans area saw revenue contract by -10.5 percent. Baton Rouge and Bossier City/Shreveport followed closely with declines of -6.8% and -6.6%, respectively. In contrast, the December reopening of Horseshoe Lake Charles led to an annual gain of 6.7% for the Lake Charles market.

In Indiana, the first half revenue decline was primarily driven by a 4.5 percent drop in revenue at properties in the Chicagoland market, likely as a result of the opening of two Illinois properties north and west of Chicago in H1. A similar scenario unfolded in Iowa, where two out of the state’s three top-grossing casinos located in Council Bluffs saw a drop in traditional revenue following the launch of slot gaming operations at two racinos in eastern Nebraska.

Strong Hold Drives Continued Sports Betting Gains

While the start of summer and a slower sports calendar brought with it a sequential slowdown in sports betting activity compared to Q1, second quarter sports wagering revenue still jumped 56.6 percent year-over-year to $2.30 billion, a new Q2 record.

Of the quarterly total, $347.1 million was generated in states that weren’t operational one year ago: Kansas, Massachusetts and Ohio. Excluding new markets, quarterly sports betting revenue was up 33.0 percent year-over-year. After the introduction of online sports betting in Massachusetts during March, the Commonwealth swiftly establishing itself as a significant sports betting market, generating revenue of $155.3 million from a handle of $1.37 billion during its first full quarter of operation.

After six months of 2023, commercial sports betting remains on track for another record-setting year with the year-to-date total reaching $5.15 billion, up 65.5 percent from the same period last year. Same market revenue grew 39.2 percent compared to the first half of 2022.

Nationwide, Americans bet $23.51 billion on sports in the second quarter, accelerating by 19.7 percent compared to the same period in 2022. Handle growth was relatively moderate compared to the 56.6 percent jump in revenue, reflecting rising hold rates across several jurisdictions in recent quarters. Through the first half of 2023, every sports betting jurisdiction that was live in H1 2022 saw revenue accelerate at a faster pace than handle. This includes 11 more mature markets that have experienced simultaneous growth in handle and contraction in revenue.

iGaming Growth Story Continues

The iGaming vertical continued its robust growth with $1.48 billion in Q2 revenue, up 22.6 percent compared to Q2 2022 and tying Q1 for a single-quarter record. At the state level, iGaming set new quarterly revenue records in Connecticut, New Jersey, Pennsylvania and West Virginia.

After two very strong quarters, iGaming is on track for another record year with year-to-date revenue of $2.97 billion, 22.6 percent ahead of the same period last year. Six iGaming markets were live during the first half of 2023 (excluding Nevada online poker), unchanged from a year ago.

Categoría:Reports & Data

Tags: American Gaming Association,

País: United States

Región: North America

Event

ICE Barcelona 2026

19 de January 2026

NOVOMATIC 2026: Global Expansion and Comprehensive Strategy in the Gaming Industry

(Barcelona, SoloAzar Exclusive).- NOVOMATIC AG kicked off 2026 with strong momentum, underscored by its standout presence at ICE Barcelona. Thomas Schmalzer, VP of Global Sales and Product Management, highlighted the company’s presentation of its integrated 360-degree portfolio—spanning cabinets, gaming content, and system solutions—while reinforcing global partnerships and advancing into new markets.

Friday 06 Mar 2026 / 12:00

Nadia Popova from EGT on ICE Barcelona 2026:"The new concept of our stand made a strong impression on visitors"

(Barcelona, SoloAzar Exclusive).- In this post-event interview from Barcelona, Nadia Popova, EGT’s Chief Revenue Officer and VP Sales & Marketing shares insights on the company’s standout presence, its “All eyes on us” stand concept, key product highlights, and the strategic partnerships forged at ICE Barcelona 2026.

Friday 20 Feb 2026 / 12:00

Luz Beatriz Jaramillo Serna of 21Viral: “Our presence at ICE Barcelona 2026 was exceptionally positive”

(Barcelona, SoloAzar Exclusive).- Following her participation at ICE Barcelona 2026, Luz Beatriz Jaramillo Serna, Head of Business Development, Marketing and Sales for Latin America at 21Viral, analyzes the commercial impact of the event, the trends set to shape the industry’s direction, and the company’s strategic priorities to consolidate growth across the region and new regulated markets.

Monday 16 Feb 2026 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.